TLDR

- The Hyperliquid team, through its HyperCore infrastructure, has announced its support for the HIP-4 proposal, which aims to introduce prediction markets to the platform.

- Following this announcement on Monday, the price of the HYPE token saw a significant increase of 19.5%, reaching $37.14.

- This new feature will enable users to participate in markets such as political elections and sports events, with trades structured without leverage or the risk of liquidations.

- Currently, the prediction markets functionality is undergoing testing on the testnet and will utilize Hyperliquid’s native stablecoin, USDH.

- Hyperliquid continues to hold its position as the leading decentralized platform for perpetual futures in the cryptocurrency space.

Hyperliquid revealed on Monday that its core infrastructure team will back the HIP-4 proposal. This development led to a 19.5% surge in the HYPE token’s price, bringing it to $37.14.

The proposal is designed to introduce prediction markets to the platform, allowing users to place bets on events such as political elections and sports outcomes.

HyperCore, the entity responsible for Hyperliquid’s layer-1 network, stated that this move is a direct response to significant user demand. The team perceives a strong potential for prediction markets and instruments similar to options on their platform.

HyperCore will support outcome trading (HIP-4). Outcomes are fully collateralized contracts that settle within a fixed range. They are a general-purpose primitive that are useful for applications such as prediction markets and bounded options-like instruments. There has been…

— Hyperliquid (@HyperliquidX)

This new feature will differ from conventional derivatives trading, as users will be able to place bets with capped payouts that resolve within predefined ranges.

These contracts will operate without leverage, liquidations, or margin calls, functioning more like betting slips with predetermined maximum potential returns.

Hyperliquid currently stands as the largest decentralized perpetual futures cryptocurrency platform. The addition of prediction markets would integrate two highly popular use cases within the crypto space.

If you are feeling FOMO on don’t worry, I don’t think we go parabolic until after $80

And you probably get to bid ~32 once more

— Guy (@Credib1eGuy)

Both on-chain perpetual futures and blockchain-based prediction markets typically see hundreds of millions in daily trading volume. This integration could potentially attract users from both of these sectors.

The team has clarified that the outcomes trading feature is still under development and is currently being tested on the testnet environment prior to any mainnet launch.

Technical Details and Market Position

Upon its launch, the prediction markets will utilize Hyperliquid’s native stablecoin, USDH, for canonical markets, ensuring that bets are denominated in a stable asset.

The recent price surge contributes to HYPE’s strong performance in the short term. The token has appreciated by 46.9% over the past month, even as broader cryptocurrency markets have experienced pullbacks.

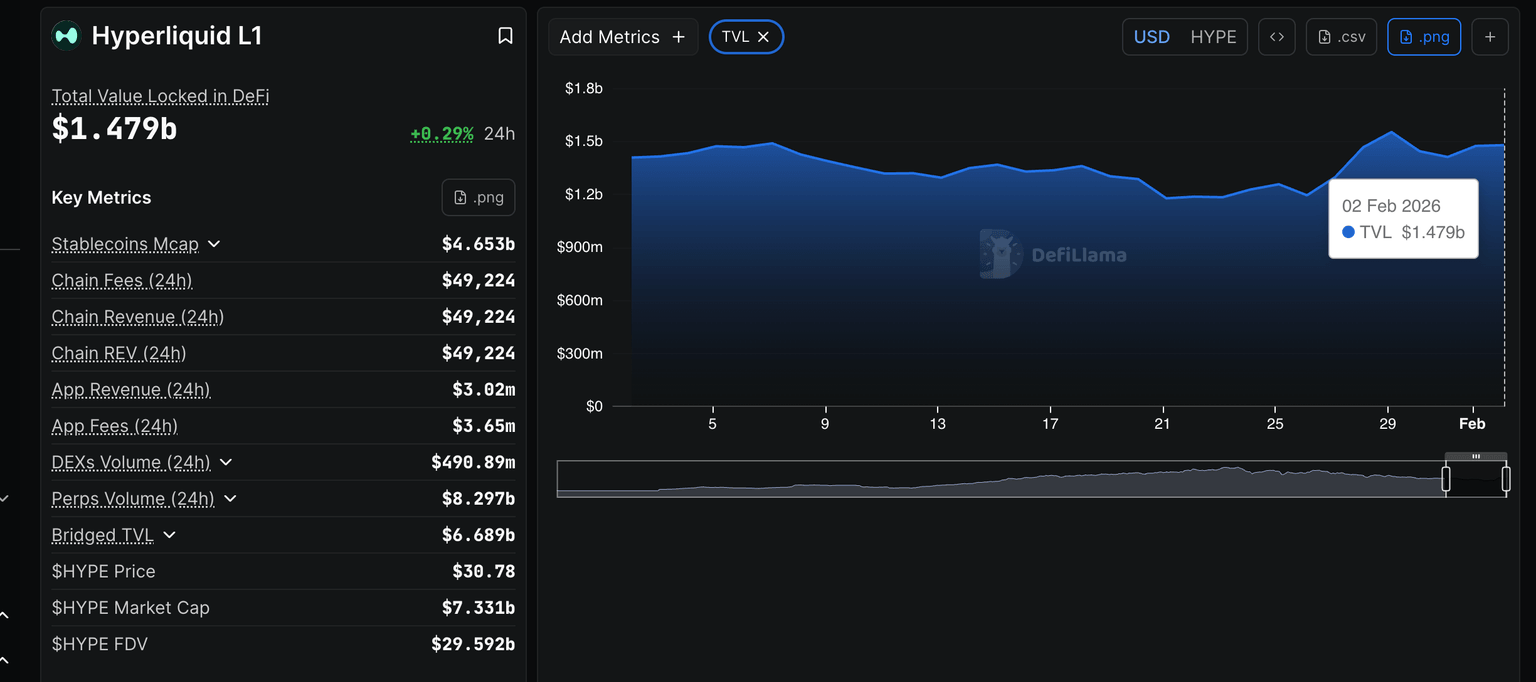

The Total Value Locked (TVL) in Decentralized Finance (DeFi) increased to $1.5 billion on Monday, up from $1.41 billion on Saturday. This metric tracks the total value of assets held within smart contracts on the blockchain.

The platform’s futures Open Interest is currently at $1.43 billion, representing the total value of all outstanding futures contracts on the exchange.

Across the cryptocurrency sector, perpetual futures trading volumes continue to exceed $200 billion weekly, which is three to four times higher than the levels observed in January 2025.

The sector reached a peak of $341.7 billion in weekly volume between November 3 and November 9. While trading activity has moderated since then, it remains at an elevated level.

HYPE is currently trading above its 50-day Exponential Moving Average (EMA) of $27.58. The 100-day EMA at $30.45 is also providing additional support.

The token is encountering resistance at the 200-day EMA, which stands at $32.68. A successful breach of this level could potentially drive prices towards $35.01.

The HIP-4 proposal signifies Hyperliquid’s strategic expansion into new market segments, with the platform aiming to broaden its offerings beyond perpetual futures contracts.